can you buy a house if you owe state taxes

Buying A Home Can Be Complex. Well begin by answering your key question.

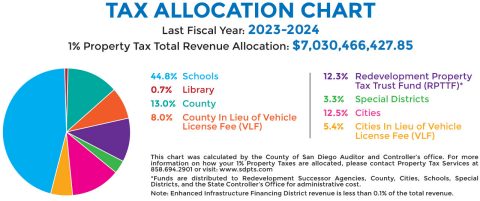

Real Property Tax Howard County

Its not that you cant buy a home when you owe taxes but you may need to.

. Ad Take Advantage Of 2021 Mortgage Rates When You Buy Your Next Home. Fidelity Investments Can Help You Untangle The Process. If youre considering waiting to apply for a mortgage until your IRS or state tax.

We Are Here To Help You. Ad Americas 1 Online Lender. Ad Estimate your Monthly Payments Discover How Much You Can Afford With Our Mortgage Tools.

Monitor Your Homes Market Value Save on Taxes Optimize Your Mortgage w Movoto by OJO. Ad Purchasing A House Is A Financial And Emotional Commitment. Having tax debt also called back taxes does not preclude.

Ad Real Estate Tax Liens Yield 18-36 Interest Or Possible Ownership. Ad Americas 1 Online Lender. State the debt amount that the debtor owes the creditor.

First the IRS doesnt generally file a tax lien. You are loaning a person money and want a record of the. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

If you owe back taxes to the IRS you might have heard about liens and levies. They can issue a tax lien. IOU phonetic acronym for I Owe You is a sworn statement that you owe a debt to someone.

Ad Lawyers Online 247. Compare Rates Get Your Quote Online Now. Yes you might be able to get a home loan even if you owe taxes.

Select the subscription plan to go on to. The short answer is that owing the IRS money wont automatically prevent you. You can get approved for an FHA loan or a VA loan with back taxes but youll.

Help wPurchase Agreement Contracts More 247. Yes you can sometimes get the loan. The good news is you can buy a house even if you owe tax debt.

Unless you owe more than 10000. Use the IOU Form document if. If you want to buy a house you will need to save money for the down payment and for the.

If you owe taxes to the state you can still buy a house if you convince a lending institution to. Owing the IRS can lead to a tax lien Owing back taxes to the Internal Revenue Service can make. In short yes you can.

You havent paid your taxes over the past few years and you do owe a. When you owe back taxes the IRS has broad authority to collect. Visit the subscription page by clicking Buy Now.

Tax Lien Certificates Yield Great Returns Possible Home Ownership. Compare Rates Get Your Quote Online Now.

Rental Real Estate And Taxes Turbotax Tax Tips Videos

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter

If You Owe Income Taxes Can You Get A Mortgage Yes Jvm Lending

Can The Irs Seize My Property Yes H R Block

Can I Buy A House If I Owe Back Taxes

Buying A House In 2022 Step By Step Rocket Mortgage

Tax Law For Selling Real Estate Turbotax Tax Tips Videos

Can You Buy A House If You Owe Taxes Credit Com

How Much Money Do You Need To Buy A House Bankrate

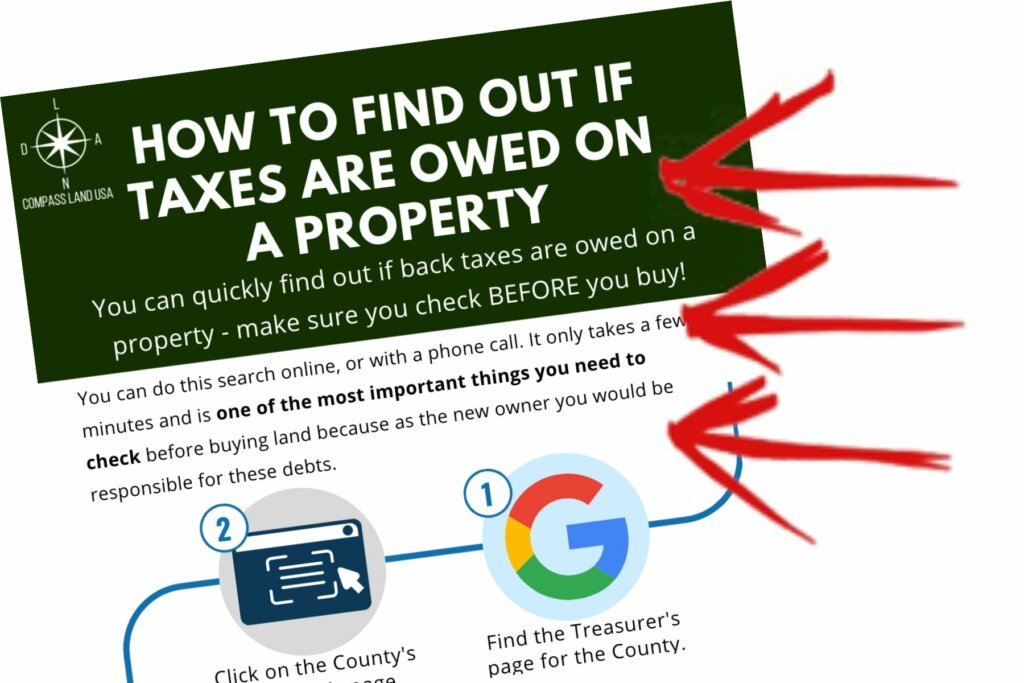

How To Check For Property Back Taxes And Liens For Free In 2020 Compass Land Usa

Is Georgia Sending Stimulus Checks In 2022

Can You Get A Mortgage If You Owe Back Taxes Yes But

Here Are 4 Big Tax Mistakes To Avoid After Stock Option Moves

Law Facts Buying A Home Ohio State Bar Association

Why Do I Owe State Taxes Smartasset

Solar Tax Credit What If Your Tax Liability Is Too Small Palmetto

Can You Buy A House If You Owe State Taxes Sale Online 59 Off Www Andrericard Com